The Median asking price for a property in the county now stands at €425,000

Property prices in County Wicklow have risen by €30,000 in the last year, according to the latest MyHome Property Price Report, compiled in in association with Bank of Ireland.

The report for the final quarter of 2025 shows that the median asking price for a property in the county is now €425,000. That means prices are down by €5,000 over the quarter.

Asking prices for a 3-bed semi-detached house in the county rose by €9,475 in the last year to €399,475. This means prices are down by €25,525 over the quarter.

Meanwhile, the asking price for a 4-bed semi-detached house in Wicklow rose by €55,000 in the last year to €565,000. This price is up by €15,000 over the quarter.

There were 495 properties for sale in Wicklow at the end of Q4 2025 – a decrease of 17% over the quarter. The average time for a property to go sale agreed in the county after being placed up for sale now stands at just over three months.

The author of the report, Conall MacCoille, Chief Economist at Bank of Ireland, said: “This quarter’s MyHome report adds to the evidence that the pace of Irish house price inflation is starting to soften. Asking prices were flat in Q4 2025, up just 0.1% in the usually quiet winter months, with the annual rate of inflation slowing to 5.4%.

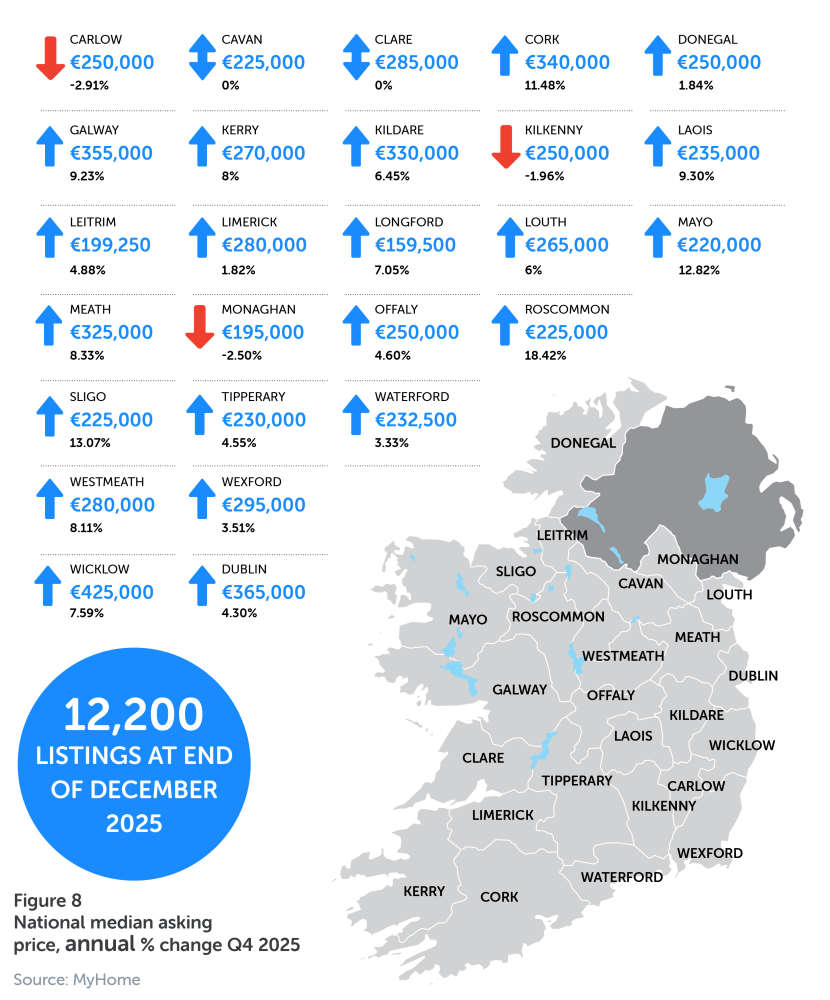

“The market is still very tight. In December there were just 12,200 properties listed for sale on MyHome. The median time-to-sale-agreed remains low at 5–6 weeks.”

Mr MacCoille added: “However, the froth in the market is subsiding a little. The median premium over asking has fallen back from a peak of 8.6% in July, to 7.4% in October and November.

“The mortgage data also pointed to more sedate mid-single digit gains heading into 2026. The overall impression from this quarter’s MyHome data is of the market pausing for breath after substantial price gains in 2024 and 2025.”

Ireland’s housing market is showing signs of settling into a steadier phase in late 2025, with bidding pressure easing from earlier highs and price growth levelling off, according to the latest MyHome Property Report in association with Bank of Ireland.

National annual asking price inflation was just over 5% in Q4, broadly in line with results the previous quarter. Asking prices were essentially flat over the period, rising only 0.1%. This stabilisation follows a period during which the CSO’s RPPI recorded 7.6% annual transaction price inflation in September, suggesting the slowdown in asking prices is set to filter through to sale prices in 2026.

Joanne Geary, Managing Director of MyHome, said: “It is encouraging to see continued momentum in residential construction, which is essential in improving choice for buyers over the medium term. Increased delivery in urban areas is critical to easing the pressures that persist in the market.

“While there are early signs of stabilisation, conditions remain tight, and buyers continue to compete for a limited pool of properties. Ensuring that supply grows steadily will be key to supporting a more balanced market in the coming years.”

Scholars Unearth Wicklow Mountains Site As Largest Known Nucleated Prehistoric Settlement

Scholars Unearth Wicklow Mountains Site As Largest Known Nucleated Prehistoric Settlement

UPDATE: N11 Vehicle On Fire Near Arklow. Care Advised

UPDATE: N11 Vehicle On Fire Near Arklow. Care Advised

Nearly €1.4m Spent To Expand Glen of the Downs Nature Reserve

Nearly €1.4m Spent To Expand Glen of the Downs Nature Reserve

Contrasting Patterns In Wicklow Crime Figures & Statistics Year-On-Year

Contrasting Patterns In Wicklow Crime Figures & Statistics Year-On-Year

Warning: Baby Formula Recalled Over Potential Toxin Risk

Warning: Baby Formula Recalled Over Potential Toxin Risk